Once signed, the engagement letter will be emailed to the relevant parties and stakeholders (legal, sales, and so on), and then filed away in a shared drive or document management system. The audit engagement letter documents and confirms the auditor’s acceptance of the appointment, the objective and scope of the audit, the extent of the auditor’s responsibilities to the client, and the form of any reports. Businesses and clients who agree to work together under certain terms often use an engagement letter to put the details of the agreement in writing. One of the parties is the professional services firm rendering its services, and the other party is the client receiving the services.

Then, the client will be responsible for paying additional hourly charges as noted on their Minc Law legal invoice. Besides defining when the relationship starts, the engagement letter also defines the end date. This end date is usually defined by the resolution of the reason for the professional relationship. For example, the relationship may end when a CPA has filed that year’s taxes, or when the attorney has completed litigation on a case. The agreement will make clear any other costs involved that are not covered in the agreement. These types of costs include filing fees or third-party fees that may arise while completing the client’s matter.

An engagement letter is used commonly with professional services such as accountants (CPAs), attorneys, and real estate agents to properly identify the relationship with the client often required under state law. Lawyers often resist detailed written client engagement agreements because of the fear that a potential client might be turned off by its length or by the self-protective (“CYA”) nature of the document. And it is true that a comprehensive engagement letter does not, and cannot, inoculate the lawyer against claims by a dissatisfied client. But the well-drafted engagement letter still is one of the best means available to minimize, or even avoid, the financial and reputational risks of disputes with clients.

Another important thing to note when auditing the parent company and its subsidiaries is that it is important to send a separate engagement letter to each. Unless otherwise noted in the accompanying engagement letter, you are Accounting Equations MCQ Quiz With Answers responsible to retain original documents as may be necessary to justify reported

revenues, expenses, etc. CFO will use its professional judgment in applying tax, accounting, or other rules applicable to this engagement.

While managing your business and law practice, it’s important that with every client and service offered, you’re taking the appropriate steps to mitigate risk as much as possible. However, it is still crucial to include every important aspect of the relationship between the provider and the client. This ensures transparency and demonstrates professionalism from the beginning of an attorney-client relationship. Engagement letters are a staple in the professional world, especially in fields such as law, accounting, and consulting.

The provider (in this case, Minc Law or another internet attorney) sends an engagement agreement before the engagement commences, to help avoid misunderstandings. Simply put, an engagement letter is a form of contract, albeit a less formal, easier-to-read version. A contract is defined as an “agreement between private parties creating mutual obligations enforceable by law.” When an engagement letter is signed, it becomes legally binding in a court of law—making it a contract. If you have ever hired a professional in any industry, you likely signed some form of contract. A written engagement letter, commonly referred to as an engagement agreement, is a type of contract—and it is a necessary foundation on which to build a professional relationship. Eventually, once the version control nightmare is over, an agreement is reached and both parties sign, either with a wet signature and a sign/scan/send process or an eSignature provider.

Be transparent about any potential fee changes and how they will be communicated. Content Snare provides a clear client dashboard that outlines exactly what documentation the client needs to provide and when. It also allows clients to ask questions right in the system and sends automatic reminders for documents that are still outstanding. This may stem from miscommunications or the client’s unreasonable expectations. You can also add in what will happen if the client requests extra services outside the scope of the current engagement.

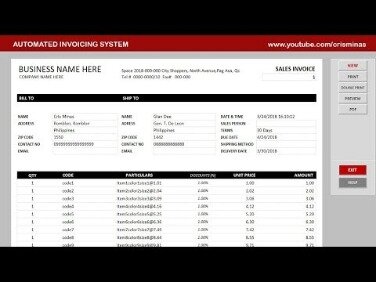

If it has to do with accounting, practice management, or Canopy, it’s here. If an auditor is not independent of a client, it can lead to non-compliance with ethical requirements and bad publicity. Ignition can save you hours of admin time by connecting it to your business apps to automate workflows from the moment your client signs the proposal. Automate invoice creation and reconciliation by integrating Ignition with Quickbooks Online or Xero, so everything happens seamlessly behind the scenes.

How Often Should Engagement Letters be Updated?

Engagement letters are essential tools for professionals, offering a clear and concise way to define the scope of their services and protect their interests. However, drafting and reviewing engagement letters can quickly become a burden for professionals, especially those in fast-growing businesses, where lawyers often report feeling overwhelmed by the volume of paperwork. Engagement letters are the foundation of the legal relationship between tax professionals and their clients. They are letters that, once signed by both you and your client, constitute a legally binding contract between you (or your practice) and the client. As such, every time you take on a new client, that relationship should begin with an engagement letter for three big reasons…

- An engagement letter is sent if and when you are ready to proceed with retaining a professional for their services.

- If, after reviewing the engagement letter, you disagree with certain elements or points in the document, you do not need to sign it right away.

- The following terms govern the engagement between the addressee of the accompanying engagement letter (You) and CFO Oncall, Inc. (CFO).

- We recommend that the attorney and the client review the terms of the agreement at least once annually.

- Engagement letters essentially help protect firms from lawsuits while offering customers clarity over what services they can expect to receive and when.

Unfortunately, Ignition doesn’t support payments in South Africa, but it’s something we’re working on in the future. You’ll still be able to engage clients seamlessly with online proposals and automated engagement letters, and run your business on autopilot by connecting apps to Ignition. It is recommended to review the terms of the agreement at least annually to ensure that any updates, if needed, are noted. If changes are required, a new engagement letter or a supplement letter should be set in place.

Key Benefits of Engagement Letters

Should the positions taken result in additional taxes, penalties, fines,

interest or any other damages, we assume no responsibility for such costs. Given the legally binding nature of this document, you should always read it through carefully before signing your name to it. This will help ensure that you not only understand your rights and obligations but also consent to the terms of engagement and understand the consequences for failing to uphold them.

- It makes sense to have an established structure for law firm engagement letters.

- Also known as “errors and omissions” insurance, it protects you from the threat of ruinous legal bills and defends your firm.

- The document will provide guidance on how to add scope to the agreed project and readjust the price of the work.

- This section will outline the process for requesting changes and obtaining mutual agreement in writing before proceeding with any revised scope or fees.

- Engagement letters are commonly required by services firms engaged in tax, audit, finance, consulting, and legal advice.

- These template sections are simply ideas to get you started on creating sample engagement letters and are not to be considered advice in creating a legal agreement between you and your clients.

You may also want to give a quick company overview to showcase your value and explain the point of the engagement letter. You should properly identify who will receive your accounting or bookkeeping services — whether that is an individual or a business. Before you create your tax and accounting business you should establish a clear vision of what you want your company to… If the auditor and the client cannot agree, the auditor should withdraw from the existing arrangement. On recurring audits, the auditor should consider whether circumstances require the terms of the engagement to be revised and whether there is a need to remind the client of the existing terms of the engagement.

Signature and date lines

If a claim is made against you by a client, your professional liability insurance comes to your defense. Also known as “errors and omissions” insurance, it protects you from the threat of ruinous legal bills and defends your firm. Without a written agreement, it would be difficult for Lisa to prove that this extra work was not agreed upon (or paid for) in advance. Engagement letters provide the client the reassurance of knowing when the attorney will complete the service. They also provide complete clarity about how much a service will cost (or the parameters for determining the entire cost).

An audit engagement letter must define the objectives and scope of the audit engagements. The audit engagement letter should be sent after verbal confirmation of the appointment of you as the auditor and ideally signed before the start of any audit work. If your client is going through a tumultuous time, they will be desperate for you to offer them some predictability. Clients want to see specific language regarding pricing, the scope of your services, and how any changes to the agreement might occur.

AccountingTools

To see our product designed specifically for your country, please visit the United States site. An attorney for more than 18 years, Jennifer Williams has served the Florida Judiciary as supervising attorney for research and drafting, and as appointed special master. Williams has a Bachelor of Arts in communications from Jacksonville University, law degree from NSU’s Shepard-Broad Law Center and certificates in environmental law and Native American rights from Tulsa University Law. In rare cases, when we at Minc Law terminate representation, we will immediately refund the balance of any funds not used from the retainer.

When Should an Attorney Withdraw From an Engagement?

Should the scope of the engagement change, CFO will prepare a Change Order letter outlining the necessary changes and the modification of fees. Fee increases resulting from Change Orders will be billed immediately and are due upon receipt. The following terms govern the engagement between the addressee of the accompanying engagement letter (You) and CFO Oncall, Inc. (CFO). Assist the Company in any due diligence requirements from any potential funding source including preparation of budgets, projections, and financial

analysis.

We recommend that the attorney and the client review the terms of the agreement at least once annually. Before you sign the engagement agreement, point out any sections that you disagree with and ask the attorney if they can alter those items in any way. Of course, when it comes to legal matters, it is not uncommon for more potential work to present itself. For instance, you may hire Minc Law to remove content from a specific website. In the course of our work, our attorneys might discover similar content that should be removed from other websites. This agreement also clarifies that we are not affiliated with third-party service providers.

What should be included in an engagement letter?

It will often be between a client and a company and will outline what the future business relationship between the parties will consist of. In that way, an engagement letter will outline what the terms of the proposed business arrangement will be as well as any fees and how those fees are structured. An engagement letter is a written agreement that describes the business relationship to be entered into by a client and a company. The purpose of an engagement letter is to set expectations on both sides of the agreement. Clarity in the fee provisions of an engagement agreement is essential because so many malpractice claims arise only when the firm seeks to collect an unpaid fee. If you elect not to require an advance deposit, you should at least reserve the right to condition future services on receipt of a deposit or advance payment.