This March, Icahn launched a proxy battle with Illumina, nominating three directors to the board and pushing the DNA sequencing company to divest its $7.1 billion 2021 acquisition of healthcare firm Grail. Since starting Tudor Investment Corporation in 1980, Paul Tudor Jones has amassed a net worth of $7.3 billion, with an average yearly return of 19 percent. In second place is Jim Simons of Renaissance Technologies, who earned $2.6 billion. Renaissance Technologies’ three main funds for outside investors were down 20% to 30%, according to report. Cooperman is known for his outspoken views on the stock market, the economy, and policy matters.

Names like George Soros, Warren Buffett, and Ray Dalio are synonymous with excellence, their track records cementing their place in the pantheon of the best hedge fund managers of all time. Collectively, the world’s 15,000 hedge funds manage around $4.5 trillion in assets for their clients, weathering economic storms and world events to ensure returns. Stocks may have plunged into a bear market in 2022 — but that didn’t stop hedge fund managers from bringing home billions of dollars in personal earnings. Most of Tiger Global’s assets are now in its venture funds, which it reportedly marked down by one-third last year as well. His esteemed quantitative trading firm, which manages some $50 billion in assets, is famous for its Medallion Fund, a $10 billion black-box strategy that is only open to Renaissance owners and employees. Though Simons officially retired in 2010, he is still involved at the firm and continues to benefit from its funds.

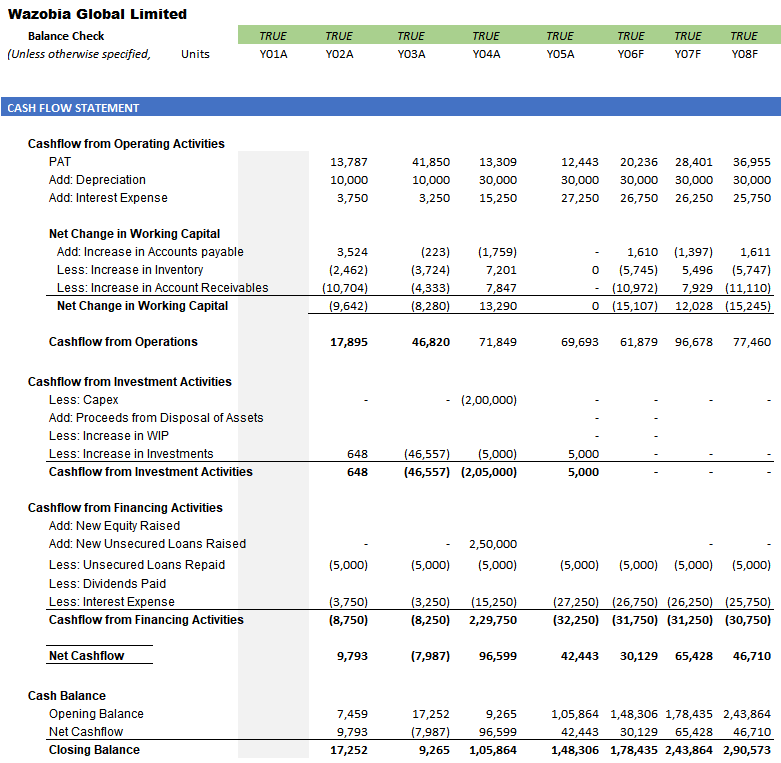

The firm’s assets under management sank from a peak of $40 billion in 2013 to less than $10 billion in 2018 following a string of lackluster returns, but assets have rebounded sharply to $30 billion today. Howard’s net worth is now at an all-time high estimate top hedge fund managers of $3.6 billion, up from $3.2 billion a year ago. As a hedge fund manager, your firm may receive up to 20% of the investment’s profits. Depending on your seniority and employer, you may receive a percentage of that on top of your annual compensation.

Druckenmiller’s partnership with George Soros resulted in the Quantum Fund achieving remarkable returns over the years. They were known for their macroeconomic analysis and their ability to capitalize on major market trends. Under Cooperman’s leadership, Omega Advisors achieved strong returns over the years. His ability to identify undervalued opportunities and navigate various market cycles contributed to the fund’s performance. Cooperman’s investment philosophy is rooted in value investing, similar to the approach of investors like Warren Buffett. His investment approach was centered around investing in undervalued stocks and engaging in extensive fundamental research.

While still involved in strategic decisions, his primary role is chief scientist. In 1987, founder Kenneth Griffin began trading from his dorm room as a 19-year-old sophomore at Harvard University. He founded Citadel in 1990 and is currently the CEO and Co-Chief Investment Officer. If you are a journalist writing a story, an academic writing a research paper or a manager writing a report, we request that you reach out to us for permission to republish this data. Additionally, we may have updated information that is not yet reflected in this table. Any plan, fund, or scheme that provides retirement income is referred to as a pension fund, also known as a superannuation fund in some countries.

Ray Dalio

“Icahn Enterprises LP, headed by investor Carl Icahn, is a diversified holding company with interests in investments, energy, automotive, food packaging, real estate, home fashion and pharmaceuticals. The investment segment derives revenues from gains and losses from investment transactions. Other operating segments, in most cases, are independently operated businesses obtained through a controlling interest. Citadel’s flagship fund, Wellington, posted a better than 38 percent gain last year, making Griffin one of the top performers in his strategy. Farallon was established in 1986 by Thomas Steyer to invest in merger arbitrage. Its investment strategies include credit investments, long/short equity, merger arbitrage, risk arbitrage, real estate, and direct investments.

The bulk of his wealth comes from the profits generated by Renaissance’s various investment funds, most notably the Medallion Fund. UK-based Brevan Howard jumped from 26th to 19th, witnessing a 46% increase in their assets under management. Get access to the news, research and analysis of events affecting the retirement and institutional money management businesses from a worldwide network of reporters and editors.

#10. David Shaw

Griffin’s Citadel has become the envy of the hedge fund industry after several years of outperformance have separated it from its peers. Griffin founded the multi-strategy firm in 1990, and it now manages $57 billion in assets. His market-making firm Citadel Securities, founded in 2002, is also a revenue-generating machine, handling more than 25% of all U.S. stock trades.

Oculus, which charges a 2.5 percent management fee, boosted its performance fee from 25 percent to 30 percent, and Composite went from 3 and 30 to 3 and 35 percent. Shaw returned a substantial portion of its 2022 profits to outside investors in Composite and Oculus. Last year, it made an estimated $8.2 billion in net profits for investors, according to LCH.

The Top 10 Best Hedge Fund Managers of All Time

Below is our analysis of the 10 hedge fund firms that dominate the space, based on total assets under management (AUM). Izzy Englander founded Millennium Management in 1989 with $35 million from friends and family. Its main multi-strategy fund returned 12.4% in 2022—generating $8 billion in net gains for investors, according to LCH Investments. Jim Simons is widely considered as one of the best candidate for the list of best hedge fund managers of all time. No list of the greatest hedge fund managers of all time would be complete without the inclusion of George Soros.

His successful prediction earned him widespread recognition and established his reputation as a prescient trader. He founded Tudor Investment Corporation, which has consistently delivered strong returns to its clients. Paul Tudor Jones is widely recognized for his macroeconomic approach to investing. His ability to consistently outperform the market over several decades has cemented his reputation as one of the greatest investors of all time. Buffett’s approach focuses on identifying undervalued companies with strong fundamentals and holding onto them for the long haul.

Carl Icahn

Funds management is the responsibility of managing a pool of money on behalf of others to maximize the amount it grows. Tepper gained widespread recognition for his investments in distressed debt during the late 1990s and early 2000s. Robertson also played a crucial role in nurturing and mentoring a generation of talented investors, often referred to as “Tiger Cubs.” Despite his impressive track record, Klarman has maintained a low public profile compared to some of his peers. The foundation has raised significant funds and has had a positive impact on various social issues.

3 Best Stocks to Buy Now, 8/9/2023, According to Top Analysts – Nasdaq

3 Best Stocks to Buy Now, 8/9/2023, According to Top Analysts.

Posted: Wed, 09 Aug 2023 11:39:00 GMT [source]

Unlike the last housing bubble, delinquencies remain near all-time lows, so the forced credit sales that compounded the problem in the last bubble should be far less of an issue. Towards the end of the last housing boom, ARMs accounted for well above 30% of all mortgages. This created a ticking time bomb as rate increases flowed into higher payments. Two Sigma Investments is based in New York and was founded by John Overdeck and David Siegel in 2001. The company uses quantitative analysis to build mathematical strategies that rely on historical price patterns and other data.

#1. Ken Griffin

One of Paul Tudor Jones’s most notable achievements was predicting the 1987 stock market crash. Bridgewater’s success can be attributed to Dalio’s innovative approach, which combines quantitative research with macroeconomic insights. These principles are a set of guiding beliefs and systematic strategies that drive Bridgewater’s investment decisions. Ray Dalio is known for his unique approach to investing, which he calls “Principles.” These individuals possess an unparalleled ability to navigate the intricate world of investing, identifying unique opportunities, and generating substantial returns for their clients.

- The firm’s assets under management sank from a peak of $40 billion in 2013 to less than $10 billion in 2018 following a string of lackluster returns, but assets have rebounded sharply to $30 billion today.

- He steadily returned money to clients over the last decade and now operates Appaloosa as a family office with $14 billion in assets, according to LCH Investments.

- These are (1) commodities, (2) credit and convertibles, (3) equities, (4) global fixed income and macro, and (5) global quantitative strategies.

- Towards the end of the last housing boom, ARMs accounted for well above 30% of all mortgages.

They are not subject to the same regulations as mutual funds and may not be required to file reports with the U.S. Itwas an up and down year for the world’s top hedge fund investors, with markets seesawing amid war in eastern Europe, rising inflation and interest rate hikes. Money market funds, bond or fixed income funds, stock or equity funds, and hybrid funds are some of the most common mutual funds. Depending on the number of assets under administration, fund management may consist of one manager, two co-managers, or a team of three or more co-managers. These managers are experts in the financial market who analyze what assets to buy and sell, intending to increase the value of the funds under their control. Chase Coleman of Tiger Global came in third place, with a $2.5 billion payday.

Carbon Emissions by Activity

Hedge funds do not use standard trading strategies but rather seek to actively manage their assets to provide extraordinary returns to their investors. In this article we’re sharing a list of 10 best hedge fund managers of all time who have earned their lives out of hedge funds. This visual breaks down the world’s biggest hedge funds in terms of assets under management using data from Pensions & Investments. They’re not created for the average investor but rather geared toward institutions and high-net-worth individuals, as many hedge funds come with minimum investment amounts, which can often be in the millions. Hedge funds are alternative investments that use various methods such as leveraged derivatives, short-selling, and other speculative strategies to earn a return that outperforms the broader market. They typically impose investment minimums of hundreds of thousands of dollars to millions of dollars and target high-net-worth individuals, pension funds, and institutional investors.

In 2019, Overdeck, a onetime math prodigy, and Siegel, an artificial intelligence expert, accepted lifetime achievement awards at Institutional Investor’s Hedge Fund Industry Awards. We picked the 15 most famous hedge fund managers based on comparison on Google Trends. We also highlighted their top stock picks based on 13F portfolios as of the end of the third quarter of 2022. The hedge fund business makes up about one-third of Griffin’s net worth, according to Forbes estimates. About half comes from Citadel Securities, Griffin’s market-making business, which provides liquidity for investors to execute trades and is separate from the hedge fund.

But the former No. 1 earner remains the only hedge fund manager to qualify for the Rich List in every year since its debut. In 2021, the mathematician and onetime government code breaker stepped down as chairman of the board of the firm he founded in 1982. Hedge funds pool assets from a variety of investors, primarily from institutions and high-net-worth individuals. These assets are then invested using proprietary trading methods that the hedge funds come up with to significantly outperform the market.

Many of these large hedge funds were new to the top 20 category, having moved up dramatically from the 2021 ranking. Hedge funds seek to employ unique strategies with the goal of providing greater returns than the market or standard investment strategies. Hedge funds come up with unique ideas to employ in the markets and charge a high price for doing so.